Your Dream Home Awaits in Grizzly Ridge West Murrieta!

Blog Post 8 41967 Cameryn Ct, Murrieta, CA Click here to Get Directions Photos Maps & Local Schools Print $ CLICK FOR CURRENT PRICE 5 BEDROOMS 3 BATHROOMS 8276 sqft Lot Stunning Family Home in West Murrieta Grizzly Ridge – No HOA, Low Taxes, RV Parking! Welcome to your dream home! Nestled in the desirable West Murrieta Grizzly Ridge area, this beautiful 5-bedroom, 3-bathroom house sits on a double cul-de-sac, offering both privacy and a peaceful neighborhood setting. One of the standout features of this home is the spacious downstairs suite, perfect for guests or extended family. With a recently remodeled backyard and a three-car garage, this property has everything you need and more. Key Features: No HOA: Enjoy the freedom to personalize your home without additional fees. Low Taxes: Benefit from significant savings each year. RV Parking: Ample space for your recreational vehicle or extra cars. Downstairs Suite: Convenient and private, ideal for guests or multi-generational living. Double Cul-de-Sac: Limited traffic and a safe environment for children to play. Interior Highlights: Open Floor Plan: Tall ceilings create a spacious and airy feel throughout the home. Ceiling Fans: Installed in both the living room and family room for comfort. Modern Look: Neutrally painted walls with plantation shutters provide a contemporary touch. Gourmet Kitchen: Features a pantry, stainless steel appliances, recessed lighting, and gorgeous Quartz countertops. Elegant Flooring: Luxury Vinyl Plank flooring downstairs with white baseboards for a clean and sophisticated look. Downstairs Bathroom: Includes travertine flooring, adding a touch of luxury. Prime Location: Your children will have the privilege of attending top-rated schools: Cole Canyon Elementary, Thompson Middle School, and Murrieta Valley High School. Additional Information: This home is designed for comfort and convenience, boasting an open layout perfect for family gatherings and entertaining. The spacious kitchen is a chef’s delight, while the remodeled backyard provides a serene outdoor space for relaxation and fun. This is the home you’ve been waiting for, and it won’t be on the market for long. Don’t miss out on this fantastic opportunity to own a piece of West Murrieta paradise! Schedule a tour today and experience all the wonderful features this home has to offer.

Exploring the Benefits: What Are the Advantages of a Structured Installment Sale?

Introduction to Structured Installment Sales Structured installment sales represent a strategic financial planning tool, especially in the realms of real estate and business transactions. At its core, a structured installment sale is a method where the seller receives the payments over time, offering a multitude of benefits for both buyers and sellers. This approach is particularly advantageous in managing taxes, cash flow, and investment planning. Key Benefits of Structured Installment Sales Tax Advantages One of the most significant benefits of structured installment sales is the potential tax savings. By spreading out income over several years, sellers can potentially reduce their overall tax burden, especially when it comes to capital gains taxes. Cash Flow Management Structured sales also offer excellent cash flow management options. For sellers, receiving payments over time can provide a steady income stream, beneficial for long-term financial planning and stability. Understanding Tax Implications Capital Gains Tax The method of structured sales can significantly impact how capital gains tax is applied. By receiving the sale proceeds over a period, sellers might lower their tax bracket in any given year, reducing the amount of tax paid on the gain. Income Spreading Income spreading is another critical aspect of structured sales. This approach allows sellers to spread their income over multiple years, which can be particularly beneficial for those in higher tax brackets. Seller’s Perspective on Structured Sales Security and Predictability From a seller’s standpoint, structured sales offer security and predictability. Fixed payments over a set period can make financial planning more straightforward and reliable. Seller’s Financing Benefits Sellers can also benefit from the interest earned on the installment payments, which can potentially lead to increased overall profit compared to a lump-sum sale. Buyer’s Advantages in Structured Sales Easier Financing For buyers, structured installment sales can mean easier financing. With lower initial payments, buyers may find it more manageable to purchase properties or businesses that might otherwise be out of reach. Budget Management Structured sales allow buyers to manage their budgets more effectively. The spread of payments over time can help in aligning the purchase with their financial capabilities and plans. Impact on Real Estate Transactions Real Estate Market Dynamics In the real estate sector, structured installment sales can influence market dynamics. This method can make high-value properties more accessible to a broader range of buyers, potentially increasing market activity. Case Studies Case studies in real estate show how structured sales have benefited both buyers and sellers, offering insights into various scenarios and outcomes. Legal Framework and Compliance Legal Requirements Understanding the legal framework surrounding structured sales is crucial. Compliance with laws and regulations ensures the legality and validity of the transaction. Ensuring Compliance Ensuring compliance involves proper documentation, adherence to tax laws, and understanding contractual obligations. It’s essential for both parties to be aware of these requirements to avoid legal complications. Structured Sales vs. Lump Sum Sales Comparative Analysis Comparing structured sales to lump-sum sales highlights the advantages and potential drawbacks of each approach, aiding in informed decision-making. Decision Making Factors Several factors influence the decision between a structured sale and a lump sum sale, including financial goals, market conditions, and personal preferences. Financial Planning with Structured Sales Long-term Financial Stability Structured installment sales can contribute significantly to long-term financial stability, offering a predictable and steady income stream over time. Investment Opportunities The staggered payments in structured sales can also open up new investment opportunities, allowing sellers to reinvest their proceeds in a more diversified and strategic manner. Risk Management in Structured Sales Identifying Risks Like any financial arrangement, structured sales come with inherent risks. Identifying these risks is the first step towards effective risk management. Mitigation Strategies Developing strategies to mitigate these risks ensures that both parties can maximize the benefits of a structured sale while minimizing potential downsides. Case Study: Success Stories Real-life Examples In 2022, Marge sold an investment property that she had owned for the last 20 years. The sale price was $1,500,000; the adjusted basis of the property was $900,000, the property wasn’t subject to a mortgage and the selling expenses associated with this transaction were $50,000. During the sale, Marge consulted with her legal and tax advisors who helped her determine that a Structured Installment Sale would be beneficial. This financial tool would provide periodic payments to help supplement her retirement and would also defer capital gain taxes on the property beyond the year of the sale. Per the Purchase and Sale agreement, the $1,500,000 purchase would be payable as follows: upfront cash of $500,000 in this year with the remaining $1,000,000 payable in 10 equal amounts beginning next year. If Marge had received the proceeds in full at the time of the sale, she would have to pay $66,458 in federal capital gain taxes. A 3.8% net investment income tax (NIIT) would also apply to a portion of the gain resulting in an additional $11,400 of taxes. Total federal taxes would be about $77,858 ($66,458 + $11,400). But, if she utilizes the Structured Installment Sale she will pay approximately $11,115 of federal capital gains taxes in the year of the sale due to the 15% capital gains rates, and $0 each year for the next 10 years due to the 0% capital gains rate.* Additionally, none of the proceeds would be subject to the 3.8% NIIT. This results in a tax savings of about $66,743. Under the tax rules applicable to installment sales, a portion ofeach payment will comprise interest and thus, will be taxed as ordinary income. Ultimately, by using a Structured Installment Sale, Marge’s capital gains and NIIT tax bill will be reduced thus preserving more of the sales proceeds and she will have the comfort of a guaranteed1 income stream. Learning from Experiences Learning from the experiences of others who have navigated structured sales successfully can offer practical guidance and confidence to those considering this approach. Experts’ Views on Structured Installment Sales Industry Expert Opinions The opinions and analyses of industry experts shed light on the nuances of structured

How to Choose the Perfect Retirement Lifestyle in SW Riverside County

Retire to SW Riverside County (Affordable, Great Weather, Lots of Activities, and Awesome Communities) How to Choose the Perfect Retirement Lifestyle in SW Riverside County Retirement is a significant milestone that opens a new chapter of freedom, relaxation, and the opportunity to live life at your own pace. Southwest Riverside County, with its picturesque landscapes and tranquil living, presents an ideal setting for retirees seeking a blend of comfort and vibrant community life. This comprehensive guide explores the key factors to consider when selecting the perfect retirement lifestyle in this beautiful region. Understanding the Allure of SW Riverside County Southwest Riverside County is renowned for its stunning natural scenery, including rolling hills, lush vineyards, and clear blue skies. The Mediterranean climate offers warm, sunny days and cool, comfortable nights, perfect for outdoor enthusiasts and those who appreciate a temperate environment. Evaluating Real Estate Options When considering retirement in SW Riverside County, the real estate market offers a diverse range of options to suit every lifestyle and budget. From luxurious gated communities to charming single-family homes, the area caters to a variety of preferences. It’s essential to assess factors like proximity to healthcare facilities, recreational amenities, and community engagement opportunities. Healthcare and Wellness Facilities Access to quality healthcare is a top priority for retirees. SW Riverside County boasts state-of-the-art medical centers, including Temecula Valley Hospital and Loma Linda University Medical Center – Murrieta. These facilities offer comprehensive healthcare services and specialized programs tailored to the needs of senior citizens. Cultural and Recreational Activities Retirement is the perfect time to pursue hobbies and interests. SW Riverside County is a hub for cultural and recreational activities, ranging from golf courses, wineries, and art galleries to nature trails and community events. The region’s rich cultural diversity also ensures a calendar packed with festivals, concerts, and exhibitions. Community Engagement and Social Life Building a network of friends and engaging in community life are vital aspects of a fulfilling retirement. Many neighborhoods in SW Riverside County offer active adult communities with organized social events, clubs, and volunteer opportunities, fostering a strong sense of belonging and camaraderie. Cost of Living and Financial Considerations While planning for retirement, it’s crucial to consider the cost of living in your chosen area. SW Riverside County offers a relatively affordable lifestyle compared to other parts of California, with a variety of housing options to fit different financial plans. Additionally, understanding tax implications, utility costs, and other expenses will help in making an informed decision. Transportation and Accessibility Ease of transportation is another critical factor for retirees. The area provides efficient public transportation options, including buses and shuttles, making it convenient to navigate around the county. Moreover, the proximity to major highways and airports adds to the region’s accessibility. Safety and Security Feeling safe in your environment is paramount, especially during retirement. SW Riverside County is known for its low crime rates and community-focused law enforcement, ensuring a secure and peaceful living experience. Final Thoughts Choosing the perfect retirement lifestyle involves a careful evaluation of various factors. SW Riverside County, with its enchanting natural beauty, vibrant community, and diverse amenities, stands as a premier destination for retirees seeking a balanced and enriching lifestyle. As you embark on this exciting journey, remember to consider your personal needs, interests, and financial situation to make the best choice for your golden years. Embrace the opportunity to explore, connect, and relax in a community that aligns with your vision of a perfect retirement. Click Here To See all Available Homes in Active Adult Communities Throughout SW Riverside County

Helpful Tips for Downsizing My Home to Something Manageable

A Comprehensive Guide to Streamlining Your Living Space Downsizing your home can be a daunting task, but it can also be an incredibly rewarding one. By streamlining your living space, you can free up time, money, and energy to focus on the things that truly matter to you. In this comprehensive guide, we’ll provide you with all the helpful tips and information you need to make the downsizing process smooth and successful. Preparing for Downsizing Clearly Define Your Goals and Reasons for Downsizing Before you embark on your downsizing journey, it’s important to take some time to reflect on your motivations. Are you looking to save money, simplify your life, or relocate to a new community? Understanding your “why” will help you make informed decisions throughout the process. Assess Your Current Lifestyle and Needs Take a close look at your daily routines and habits. How much space do you actually use on a regular basis? Are there rooms or areas that you rarely utilize? Identifying underutilized spaces is key to determining how much you can realistically downsize. Create a Detailed Inventory of Your Possessions Go through each room in your home and make a comprehensive list of all your belongings. This will help you identify items you can keep, sell, donate, or dispose of. Categorize your belongings by room, function, and sentimental value to make the sorting process more efficient. Downsizing Strategies Decluttering and Detaching from Possessions Downsizing is an excellent opportunity to declutter your life and let go of unwanted items. Consider the following approaches: The One-Year Rule: Ask yourself if you’ve used an item in the past year. If not, it’s time to let go. The Joy Rule: Does an item spark joy or positive memories? If not, consider donating or selling it. Multifunctional Furniture: Opt for furniture that serves multiple purposes to save space and reduce clutter. Maximize Storage Solutions Smart storage solutions can help you utilize every inch of your new, smaller space. Consider: Vertical Storage: Utilize wall space with shelves, hanging organizers, and wall-mounted cabinets. Under-bed Storage: Invest in storage containers that fit neatly under your bed for maximizing space. Multi-purpose Storage Ottomans and Benches: These offer additional storage space while also serving as seating or footrests. Embrace Minimalism and Multifunctionality Minimalism emphasizes simplicity and intentionality. Consider adopting a more minimalist approach to your belongings and décor. Choose pieces that are functional and aesthetically pleasing, avoiding unnecessary clutter. Utilize Technology and Cloud-Based Storage Technology can be your ally in downsizing. Consider: Digitalizing Documents and Photos: Scan important documents and photos to store them securely in the cloud, freeing up physical space. E-books and Online Entertainment: Switch to e-readers and streaming services for books and entertainment to minimize physical media. Smart Home Devices: Utilize smart home devices for automation and control, reducing the need for multiple appliances and gadgets. Consider Shared Spaces and Amenities Downsizing doesn’t have to mean giving up conveniences. Explore the possibility of: Shared Workspace: Utilize a coworking space or community center for your work needs instead of dedicating a separate room in your home. Community Amenities: Take advantage of shared amenities offered by your community, such as a gym, pool, or party room, rather than having them in your own home. Making the Move and Beyond Research and Compare Moving Options Downsizing often involves moving to a smaller space. Research different moving companies and compare their rates, services, and reliability to choose the best option for your needs. Downsizing Your Moving Load Downsizing your belongings before the move can significantly reduce your moving costs and simplify the process. Consider hosting a garage sale, donating items, or selling them online. Prioritize and Unpack Essentials FirstOnce you’ve moved to your new space, unpack the essentials first, such as bedding, toiletries, an kitchen supplies. This will help you settle in quickly and comfortably. Adapt and Embrace Your New LifestyleDownsizing can be an adjustment, but it can also be a positive change. Embrace your new, streamlined lifestyle and enjoy the freedom and flexibility it provides. Additional Resources Here are some additional resources that you may find helpful: National Association of Senior Move Managers (NASMM): https://www.nasmm.org/ Minimalism Challenge: https://www.theminimalists.com/everyone/ Downsizing a Home? 13 Tips to Get You Started: https://gustancho.com/downsizing-to-a-smaller-home/ 10 Tips On How To Downsize Your Home: https://www.stonegableblog.com/downsizing-8-ways-to-get-rid-of-your-stuff/ A Comprehensive Guide To Downsizing Your Home (2023): https://www.mymove.com/moving/planning/senior-guide-downsizing/ How To Downsize Your Home: https://www.lendingtree.com/home/mortgage/downsizing-home/ Sources Rocket Homes – 10 Tips On How To Downsize Your Home: https://www.rockethomes.com/blog/homeowner-tips/how-to-downsize LendingTree – Downsizing a Home? 13 Tips to Get You Started: https://www.lendingtree.com/home/mortgage/downsizing-home/ Extra Space Storage – Downsizing 101: Your Guide to Moving to a Smaller Home: https://www.extraspace.com/blog/moving/moving-guides-tips/downsizing-101-moving-to-a-smaller-house/ This Old House – A Comprehensive Guide To Downsizing Your Home (2023): https://www.thisoldhouse.com/storage-organization/reviews/downsizing-to-a-smaller-home Life Storage – How To Downsize Your Home in 6 Steps [Free Checklist] Ramsey Solutions – Downsizing Your Home: 3 Money Benefits: https://www.ramseysolutions.com/real-estate/3-money-smart-reasons-to-downsize

The Art of Downsizing: Navigating the Emotional Landscape

Introduction So, you’ve decided to embark on the journey of downsizing—shedding the excess and embracing a simpler life. Congratulations on taking the leap! But hold on tight; it’s not just about sorting through your belongings and picking what stays and what goes. Downsizing is an art, a delicate dance with emotions and memories. In this guide, we’ll explore the intricacies of “The Art of Downsizing: Navigating the Emotional Landscape.” The Emotional Tango of Letting Go Ties to the Past Downsizing is not merely a physical act; it’s an emotional one. We accumulate stuff, and that stuff often carries stories, memories, and sentiments. From the faded concert ticket stubs to the dusty vinyl records, every item whispers a tale of its own. The challenge lies in detaching from these tangible pieces of our past. Pro Tip: Start small. Begin with items that hold fewer emotional attachments. Once you get the hang of it, dealing with more sentimental items becomes a bit easier. Nostalgia vs. Practicality The battle between nostalgia and practicality is real. That old college sweatshirt might trigger fond memories of late-night study sessions, but do you really need it taking up space in your closet? The art of downsizing involves finding the balance between cherishing the past and making room for the present. Pro Tip: Take a photo! If you can’t part with an item but don’t have room for it, snap a picture to preserve the memory without the clutter. Strategies for a Smooth Downsizing Process The Three-Box Method Ever heard of the three-box method? It’s a downsizing classic! Grab three boxes—label them “Keep,” “Donate,” and “Toss.” As you go through your belongings, toss each item into the appropriate box. Simple, right? This method adds a touch of organization to the emotional rollercoaster. Pro Tip: Enlist a friend. A second opinion can be invaluable, helping you stay on track and offering a fresh perspective. Room-by-Room Revolution Don’t overwhelm yourself by attempting to tackle the entire house at once. Break it down room by room. Start with the least emotionally charged space, like the laundry room or the guest bedroom. Once you build momentum, moving to more sentimental areas becomes a breeze. Pro Tip: Celebrate small victories. Completing a room is an achievement! Treat yourself to a coffee break or a quick dance party before diving into the next space. Frequently Asked Questions (FAQs) How do I decide what to keep? This is the million-dollar question, isn’t it? When in doubt, ask yourself, “Does this item enhance my life?” If the answer is a hesitant “maybe” or a flat-out “no,” it might be time to part ways. Pro Tip: Keep the classics. Focus on items with enduring value, both sentimental and practical. What if my family objects to downsizing? Family dynamics can add an extra layer of complexity. Communication is key. Explain your reasons for downsizing and emphasize the positive aspects, like a more manageable living space and reduced stress. Pro Tip: Involve them in the process. Turning downsizing into a family affair can make it a bonding experience rather than a source of tension. The Joy of Minimalism: Embracing the Positive Liberating Your Space As you declutter, envision the freedom that comes with it. Less stuff means more space—physically and mentally. Embrace the joy of a minimalist environment where every item serves a purpose. Pro Tip: Get creative with storage solutions. Maximizing space doesn’t mean sacrificing style. Invest in multi-functional furniture that combines form and function. A Fresh Start in a New Space Downsizing often accompanies a change in living arrangements. Whether you’re moving to a smaller home or redesigning your current space, see it as an opportunity for a fresh start. New beginnings come with new possibilities. Pro Tip: Personalize your space. Bring a few cherished items that make the new place feel like home from day one. Conclusion: Mastering the Art of Downsizing Navigating the emotional landscape of downsizing is indeed an art form. It’s about more than just decluttering; it’s a journey of self-discovery and prioritization. So, as you embark on this adventure, remember to embrace the sentimental moments, celebrate the victories, and savor the joy of a simpler, more intentional life. In the grand tapestry of “The Art of Downsizing: Navigating the Emotional Landscape,” you are the artist. Paint your future with the colors of cherished memories and the freedom of a clutter-free existence. Happy downsizing!

About Spencer’s Crossing: A Master-Planned Haven in Murrieta California

When it comes to finding the perfect place to call home, a balance of comfort, convenience, and community is paramount. Spencer’s Crossing, a remarkable master-planned community, emerges as a shining example of such an ideal residential haven. Developed by the renowned Lennar, this sprawling community nestled in the heart of French Valley, Riverside County, California, is poised to redefine modern living.

Exploring the neighborhood of Morningstar Ranch In the French Valley area of Winchester, CA

Learn more about the neighborhood of Morningstar Ranch In the French Valley area of Winchester, CA

Today’s Housing Inventory Is a Sweet Spot for Sellers

Today’s Housing Inventory Is a Sweet Spot for Sellers One of the biggest challenges in the housing market right now is how few homes there are for sale compared to the number of people who want to buy them. To help emphasize just how limited housing inventory still is, let’s take a look at the latest information on active listings, or homes for sale in a given month, as it compares to more normal levels. According to a recent report from Realtor.com:  “On average, active inventory in June was 50.6% below pre-pandemic 2017–2019 levels.† The graph below helps illustrate this point. It uses historical data to provide a more concrete look at how much the numbers are still lagging behind the level of inventory typical of a more normal market (see graph below): It’s worth noting that 2020-2022 are not included in this graph. That’s because they were truly abnormal years for the housing market. To make thecomparison fair, those have been omitted so they don’t distort the data. When you compare the orange bars for 2023 with the lastnormal years for the housing market (2017-2019), you can see the count ofactive listings is still far below the norm. What Does This Mean forYou?  If you’re thinking about selling your house, that low inventory is why this is a great time to do so. Buyers have fewer choices now thanthey did in more normal years, and that’s continuing to impact some keystatistics in the housing market. For example, sellers will be happy to see thefollowing data from the latest Confidence Index from the NationalAssociation of Realtors (NAR): Facebook Twitter LinkedIn

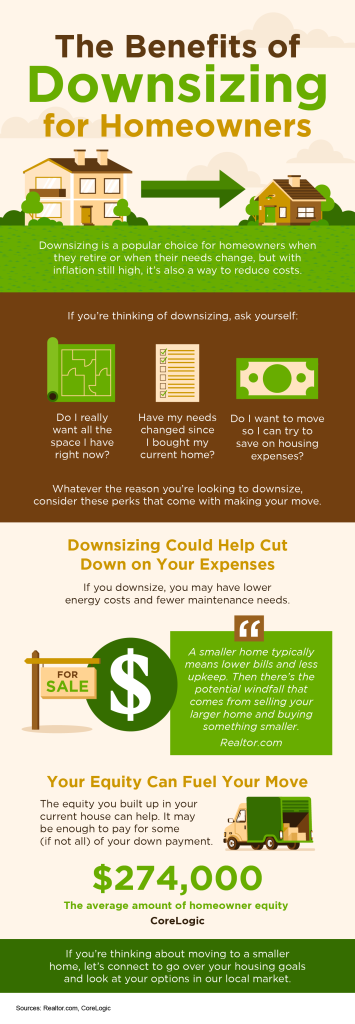

The Benefits of Downsizing for Homeowners

Planning To Sell Your Home This Year? Here’s Why You Should Work With A Real Estate Agent Some Highlights Downsizing is a popular choice for homeowners when they retire or when their needs change, but with inflation still high, it’s also a way to reduce costs. Downsizing could help cut down on your expenses and your equity can fuel your move. If you’re thinking about moving to a smaller home, let’s connect to go over your housing goals and look at your options on our local market. Facebook Twitter LinkedIn

Evaluating Your Wants and Needs as a Homebuyer Matters More Today

Evaluating Your Wants and Needs as a Homebuyer Matters More Today When it comes to buying a home, especially with today’s affordability challenges, you’ll want to be strategic. Mortgage rates impact how much it costs to borrow money for your home loan. And, to help offset the higher borrowing costs today, some homebuyers are taking a close look at their wish list and re-evaluating what features they really need in their next home to avoid overextending. As a recent NerdWallet article says: “A pool, for example, may be nice to have, but it may not provide as much day-to-day value as a garage or a space for a home office . . .†While that pool may be appealing, think twice on whether or not it’s really something you must have to be happy in your next home. Is getting that pool the main reason you’re moving? Probably not. It’s more likely a need for more space, a home office, or proximity to loved ones, friends, or work that’s motivating you to make a change. So, if you’re looking to buy a home, take some time to consider what’s truly essential for you in your next house. Make a list of all the features you’ll want to see, and from there, work to break those features into categories. Here’s a great way to organize your list: Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle (examples: distance from work or loved ones, number of bedrooms/bathrooms, etc.). Nice-To-Haves – These are features you’d love to have but can live without. Nice-to-haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of these, it’s a contender (examples: a second home office, a garage, etc.). Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner (examples: a pool, multiple walk-in closets, etc.). Once you’ve categorized it in a way that works for you, discuss your top priorities with your real estate agent. Remember to think carefully about what’s a non-negotiable for your lifestyle and what’s a nice-to-have that’s more of an added bonus. Be sure to discuss where each feature falls with your agent. They’ll be able to help you refine the list further, coach you through the best way to stick to it, and find a home in your area that meets your top needs. Bottom Line Putting together your list of necessary features for your next home might seem like a small task, but it’s a crucial planning step on your homebuying journey today. If you’re ready to find a home that fits your needs, let’s connect. Facebook Twitter Pinterest LinkedIn