Introduction to Structured Installment Sale and Case Example

The Structured Installment Sale provides guaranteed income for qualifying property or business sales that are eligible for the installment method under Internal Revenue Code Section 453.

Introduction to Structured Installment Sale and Case Example

Are you planning to sell your business or real estate holding this year? If so, you might be facing the prospect of a substantial capital gain. It’s important to evaluate the tax and financial options available for the proceeds from such transactions. One solution that is tax-efficient and provides guaranteed1 income to help secure your future is Metropolitan Tower Life’s Structured Installment Sale product.

What is a Structured Installment Sale?

The Structured Installment Sale is an annuity that allows you to defer potentially large capital gains tax and receive guaranteed installment payments over time. This installment sales approach allows you to choose what amount you’d like to receive now and how much you’d like to put into an annuity. The payment stream can be set to fit more immediate needs or help plan for the longer term, like retirement.

For a transaction to qualify as a Structured Installment Sale, it must be an eligible property in which you receive at least one payment after the tax year of the transaction.2

Eligible property sales include, but are not limited to:

- Sale of Real Estate:

- Personal Property (e.g. a home)

- Commercial Property (e.g. an office or apartment building, a retail store, farm lands, etc.)

- Sale of a Business (e.g. dental or veterinary practice)

Sellers should consult with their tax advisors to determine if a prospective sale qualifies for our Structured Installment Sale product.3

What are the advantages of the Structured Installment Sale?

- Deferral and potential reduction of capital gains, NIIT & state income tax

- Conversion of asset into a guaranteed income stream, immune to market volatility and performance

- Payments guaranteed by a financially sound and trusted company1

How does a Structured Installment Sale work?

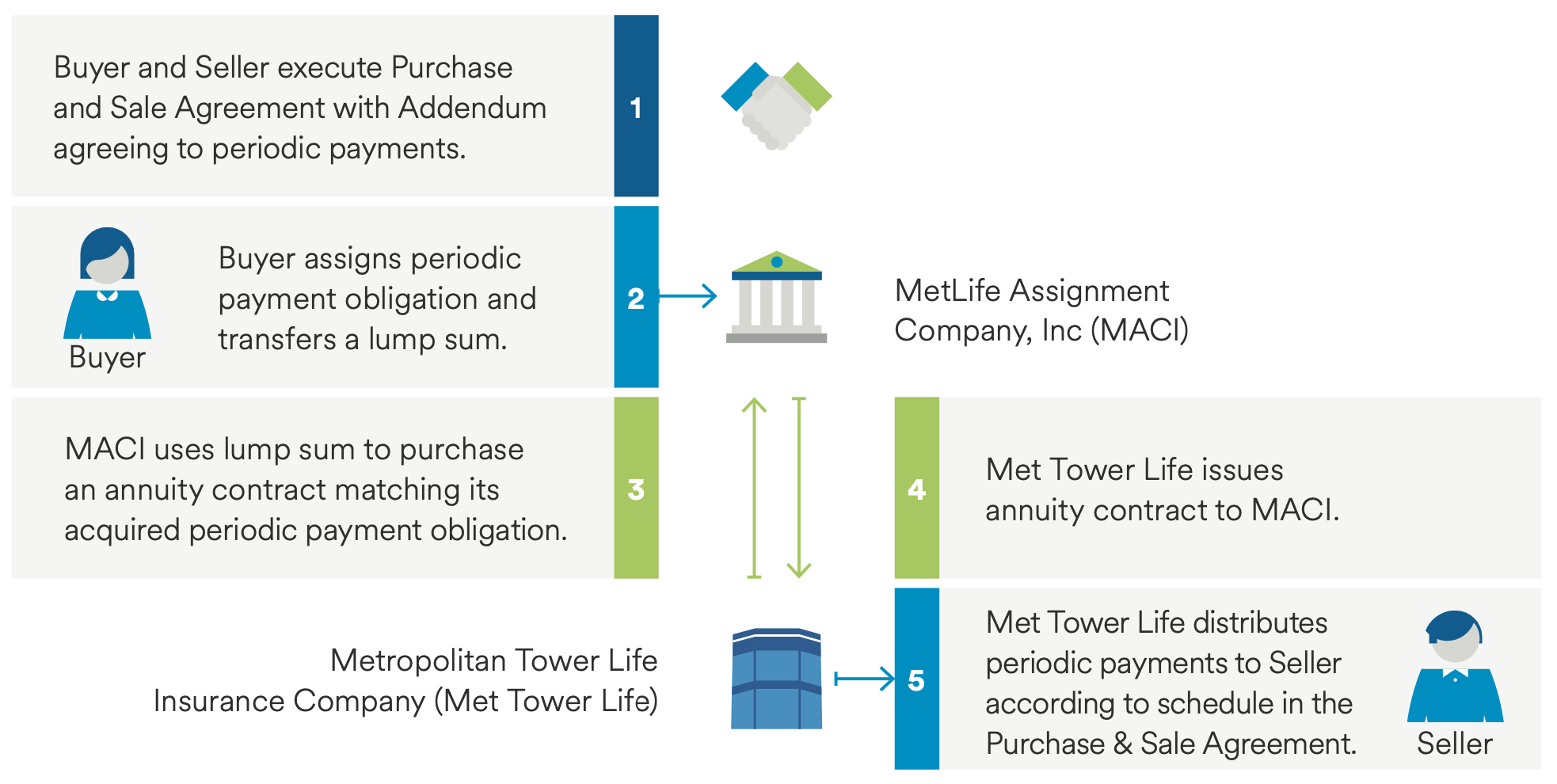

Instead of receiving one lump sum, all parties agree to periodic payments for a stated number of years as a condition of the property sale. The periodic payment obligation is then transferred to MetLife Assignment Company Inc. (MACI) by the Buyer, who pays the full premium to cover the payments. MACI takes the Buyer’s premium check for the periodic payments and purchases an annuity from Metropolitan Tower Life Insurance Company (Met Tower Life). Met Tower Life then issues the scheduled payments to the Seller on behalf of MACI. Both entities are wholly owned, U.S. based subsidiaries of MetLife Inc. and, as such provide great confidence for all parties.

The Met Tower Life Advantage

The Structured Installment Sale is provided by Metropolitan Tower Life Insurance Company, (Met Tower Life), an insurance industry leader and a leader in the structured settlement market. Met Tower Life holds an A+ rating from A.M. Best, an Aa3 rating with Moody’s, an AA- with Fitch and an AA- with Standard & Poor’s. The promise of financial security is only as solid as the company making the guarantee. When you select our annuity, you are choosing a leader who will partner with you every step of the way and can provide you with a steady, dependable income stream — both now and in the future.

A Case Example:

In 2022, Marge sold an investment property that she had owned for the last 20 years. The sale price was $1,500,000; the adjusted basis of the property was $900,000, the property wasn’t subject to a mortgage and the selling expenses associated with this transaction were $50,000.

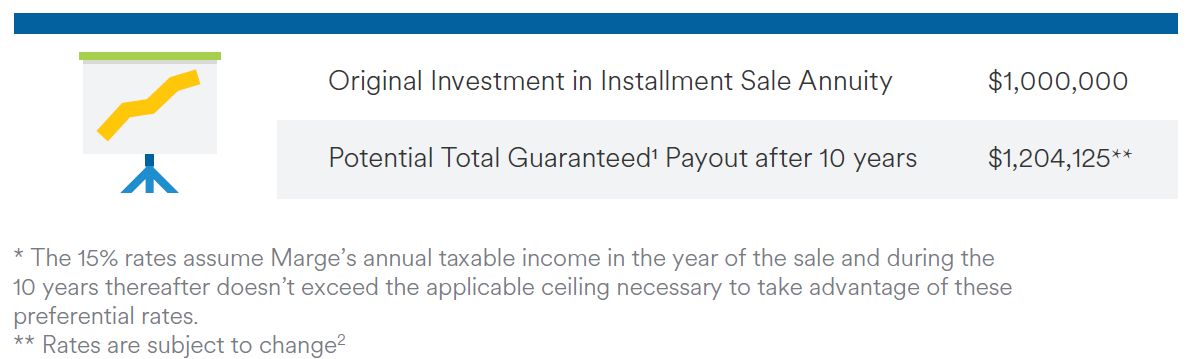

During the sale, Marge consulted with her legal and tax advisors who helped her determine that a Structured Installment Sale would be beneficial. This financial tool would provide periodic payments to help supplement her retirement and would also defer capital gain taxes on the property beyond the year of the sale. Per the Purchase and Sale agreement, the $1,500,000 purchase would be payable as follows: upfront cash of $500,000 in this year with the remaining $1,000,000 payable in 10 equal amounts beginning next year.

If Marge had received the proceeds in full at the time of the sale, she would have to pay $66,458 in federal capital gain taxes. A 3.8% net investment income tax (NIIT) would also apply to a portion of the gain resulting in an additional $11,400 of taxes. Total federal taxes would be about $77,858 ($66,458 + $11,400).

But, if she utilizes the Structured Installment Sale she will pay approximately $11,115 of federal capital gains taxes in the year of the sale due to the 15% capital gains rates, and $0 each year for the next 10 years due to the 0% capital gains rate.* Additionally, none of the proceeds would be subject to the 3.8% NIIT. This results in a tax savings of about $66,743. Under the tax rules applicable to installment sales, a portion ofeach payment will comprise interest and thus, will be taxed as ordinary income.

Ultimately, by using a Structured Installment Sale, Marge’s capital gains and NIIT tax bill will be reduced thus preserving more of the sales proceeds and she will have the comfort of a guaranteed1 income stream.

How was Marge’s capital gain calculated?

The capital gain taxes were computed by first determining the amount of gross profit (none of which is subject to depreciation recapture rules): Selling price of $1,500,000 less adjusted basis (including expenses of the sale) of $950,000 equals agross profit of $550,000. The gross profit factor is 36.67% ($550,000 gross profit divided by $1,500,000 contract price).

In the year of the sale and using an installment sale, Marge received only the down payment of $500,000. In applying the gross profit factor of 36.67%, Marge must report $183,350 of capital gain income resulting in about $11,115 of capital gains taxes. For the ten years following the year of the sale, Marge receives $123,724 per year. In applying the gross profit factor of 36.67% to $100,000 of the payment and assuming the remainder is treated as interest, Marge must report $36,670 of capital gain income resulting in about $0 of capital gain taxes annually during this period.

Tax computations assume: Marge’s filing status is married filing joint; the applicable standard deduction is $25,900; Marge has no othertaxable income; 2022 federal capital gains rates apply for the duration of the installment sale. State taxes may apply and are not reflected in the computations.

This example is hypothetical in nature and actual results will vary. For further information about the federal tax treatment of installment sales, see IRS publication 537 at www.irs.gov.

WHAT YOU NEED TO DO TO GET MORE INFORMATION OR SEE IF A STRUCTURED SALE WILL WORK FOR YOUR SITUATION